Customs Control in Ecuador, an Overview of the 2013 - 2016 Period

DOI:

https://doi.org/10.29019/eyn.v7i2.171Keywords:

custom control, risk control, EcuadorAbstract

Ecuador has, as main sources of financing of its budget, the revenues from exports, especially from sales of oil and its derivatives; international financing and tax collection. Of this last one, an important component is the customs collection, whose major items correspond to Ad valorem taxes, Taxes to Special Consumers, Safeguards and Value Added Tax. Hence the reason for the National Customs Service to deploy strategies and plans that allow them to ensure adequate customs control. The international regulations include a series of concepts that facilitate the execution of operations, both within the country and in cooperation with the Customs Administrations of other States. Ecuador has undertaken a process of modernization of the Customs System, which has included legal reforms, technological equipment, optimization and development of human talent, development and implementation of processes and procedures; all of which has led to an increase in revenues, reduction of dispatch times, efficiency in land and sea patrols, and a large deployment of subsequent control, among other aspects.

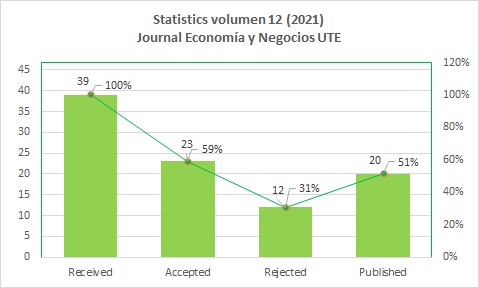

Downloads

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 The Authors

This work is licensed under a Creative Commons Attribution 3.0 Unported License.

The articles and research published by the UTE University are carried out under the Open Access regime in electronic format. By submitting an article to any of the scientific journals of the UTE University, the author or authors accept these conditions.

The UTE applies the Creative Commons Attribution (CC-BY) license to articles in its scientific journals. Under this open access license, as an author you agree that anyone may reuse your article in whole or in part for any purpose, free of charge, including commercial purposes. Anyone can copy, distribute or reuse the content as long as the author and original source are correctly cited. This facilitates freedom of reuse and also ensures that content can be extracted without barriers for research needs.

Creative Commons Attribution 4.0 International License

The Journal Economía y Negocios is distributed under a

Creative Commons Attribution 4.0 International (CC BY 4.0).

In addition, the journal Economía y Negocios guarantees and declares that authors always retain all copyrights to the original published works without restrictions [© The Author(s)]. Acknowledgment (BY): Any exploitation of the work is allowed, including a commercial purpose, as well as the creation of derivative works, the distribution of which is also allowed without any restriction.